According to a recent report from the National Low Income Housing Coalition, Virginia is one of the most challenging states for low-wage workers to find affordable housing. For instance, the minimum wage in Virginia is $7.25 per hour. In order to afford the Fair Market Rent for a two-bedroom apartment, a typical minimum-wage earner in Virginia must work 114 hours per week, 52 weeks per year. This schedule and workload is untenable, especially for workers trying to raise families.

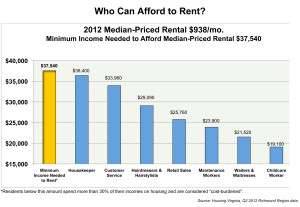

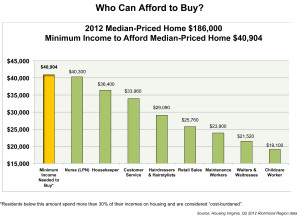

The chart at left compares median Richmond-area rents against the average annual incomes of several local minimum-wage jobs. As you can see, securing a decent apartment in Greater Richmond is out of reach for many low-income workers; and many give up hope of ever being able to buy a home and build equity (see chart below).

These data underscore challenges facing the lowest income renters: increasing rents, stagnant wages, and a shortage of affordable housing. One solution is to increase the number of affordable housing units for sale and rent.

“The healthiest communities are those with mixed incomes,” said Bob Newman, vice president and chief operating officer of the Better Housing Coalition. “High-quality affordable housing creates more opportunities and choices leading to stable and thriving neighborhoods.”

Fulfilling BHC’s mission takes much collaboration and partnership between state and local governments, housing organizations, and the support of corporations, foundations and individuals. On behalf of the thousands of residents who are leading better lives, thank you for your support!